The EMV liability shift is now less than three weeks away! Is your business prepared for an influx of chip card-carrying customers? You may have installed new terminals and software, but now what?

If you’ve been to Target recently, you may have noticed that the staff is now actively encouraging all customers who have EMV chip cards to run them the proper way—by dipping them in the terminal, instead of swiping. Now, accepting EMV chip cards is great for your business and even better for customers—but it can be bad for your checkout line wait times if your customers don’t know how to run them properly.

So, now it’s time to train your staff. It’s important for your employees to be patient as millions of Americans learn how to use their new cards. It’s certainly not hard to run an EMV card, but it is a significant change in the way we’re used to paying. It’s a change of habit, and it will take time for the public to become completely comfortable with the new payment process. You can share this infographic with your employees to bring them up to speed on this new-fangled technology. When they understand how to use the terminals, it will be easier for them to explain to customers how to use them as well. Remember, good customer service leads to happy customers! You can see the text-only version of this guide by clicking here.

Text-Only Version:

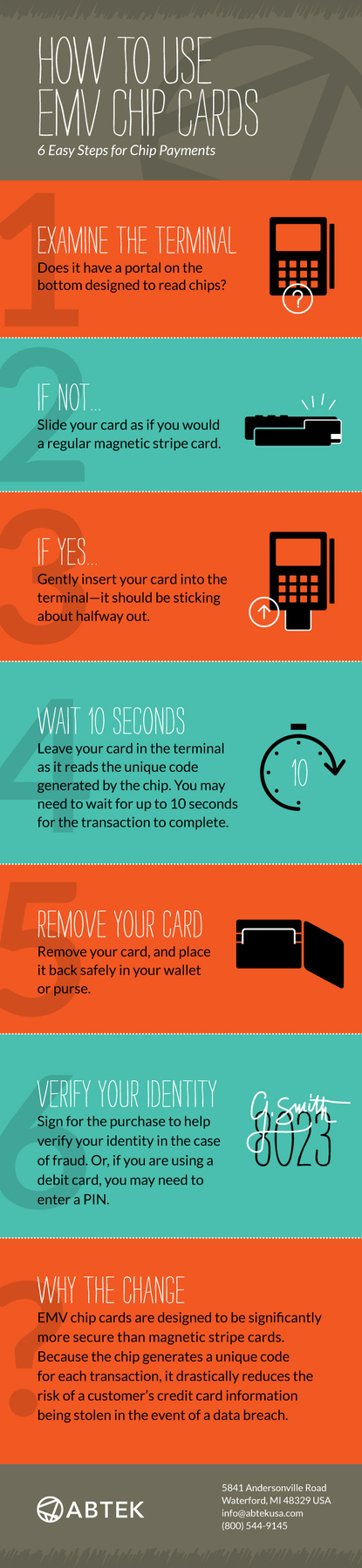

6 Easy Steps for Chip Payments

- Examine the terminal – Does it have a portal on the bottom designed to read chips?

- If not, slide your card as if you would a regular magnetic stripe card.

- If yes, gently insert your card into the terminal—it should be sticking about halfway out.

- Leave your card in the terminal as it reads the unique code generated by the chip. You may need to wait for up to 10 seconds for the transaction to complete.

- Remove your card, and place it back safely in your wallet or purse.

- Sign for the purchase to help verify your identity in the case of fraud. Or, if you are using a debit card, you may need to enter a PIN.

Why the change? EMV chip cards are designed to be significantly more secure than magnetic stripe cards. Because the chip generates a unique code for each transaction, it drastically reduces the risk of a customer’s credit card information being stolen in the event of a data breach.